Debit Cards

A debit card from Destinations provides you with direct, anytime access to your account balance for online purchases, in-store shopping, and withdrawals at ATMs.

- Complimentary with any Destinations checking account1

- Debit card purchases help qualify you for higher dividends and more with our NEW PREFERRED Rewards Checking accounts

- No additional charges or interest owed

- View an up-to-date record of transactions online

- Easily withdraw funds from ATMs:

- Surcharge-free ATM access through several networks

- Daily purchase limits: Signature $2,500; PIN/ATM $1,000.

- Safer and more convenient than carrying cash or checks

- Easily replaced if lost or stolen

- Monitor your transactions with our Mobile App

- Extra Protection for Online Shopping: Your Mastercard® Debit & Credit Cards are protected by 3D Secure. 3D Secure is a sophisticated fraud model and you are automatically enrolled. If there is a transaction that is deemed suspicious, you will receive a text message from short code 90742. You will authenticate the transaction via text message.

Important Numbers

Report a lost or stolen card

Call 888-241-2510 if in the US

Call 909-941-1398 if International

Card and PIN activation

Call 866-762-0558 if in the US

Call 501-588-7531 if international

Change your PIN

Call 866-762-0558 if in the US

Call 501-588-7531 if international

Transaction Disputes

Call 844-675-5027

We're Here for You

How to Enable Card Controls

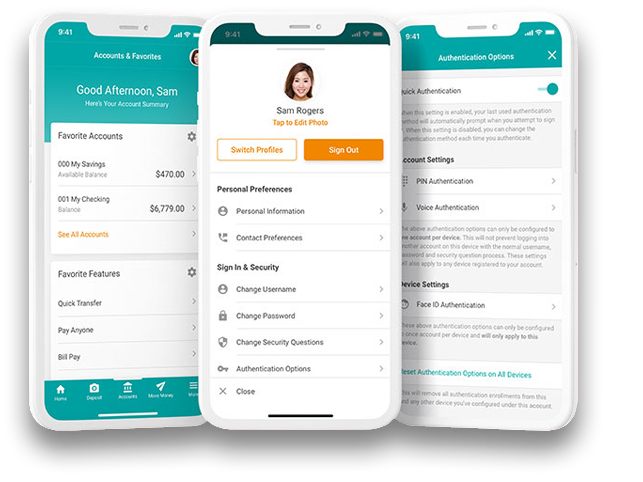

Turn your debit card on or off, or set notifications when your card is used with our card controls. To begin, Enable the Card Control Feature within your Destinations Credit Union App

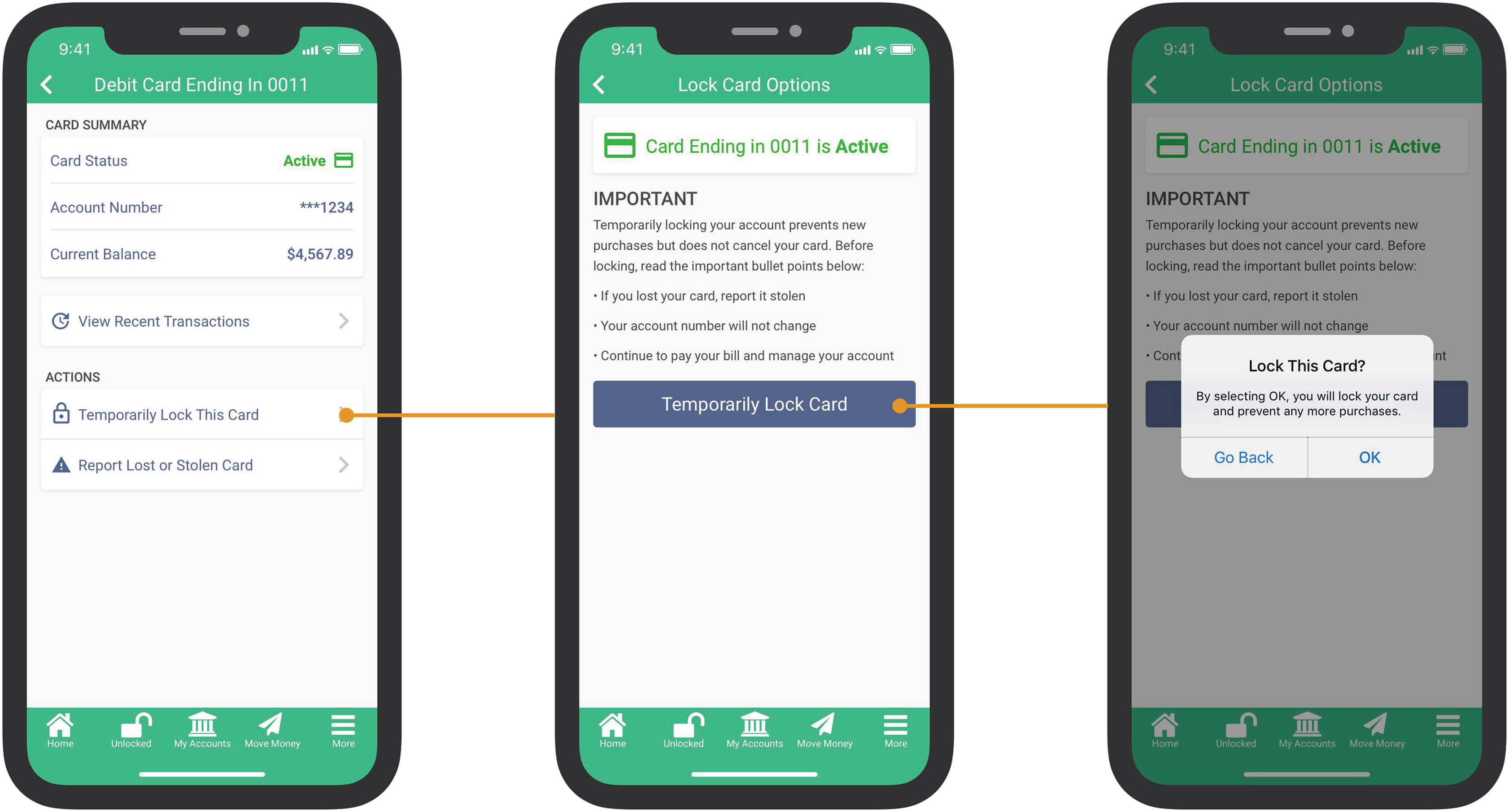

Temporarily locking your account prevents new purchases but does not cancel your card. Before locking, note the following:

- If you lost your card, report it stolen (Scroll up or click here to for the contact numbers)

- Your account number will not change

- Continue to pay your bill and manage your account

When you successfully lock your card, you will be able to see the locked status with a red lock icon. If you locate your card and want to reactivate it, you can return here to do so.

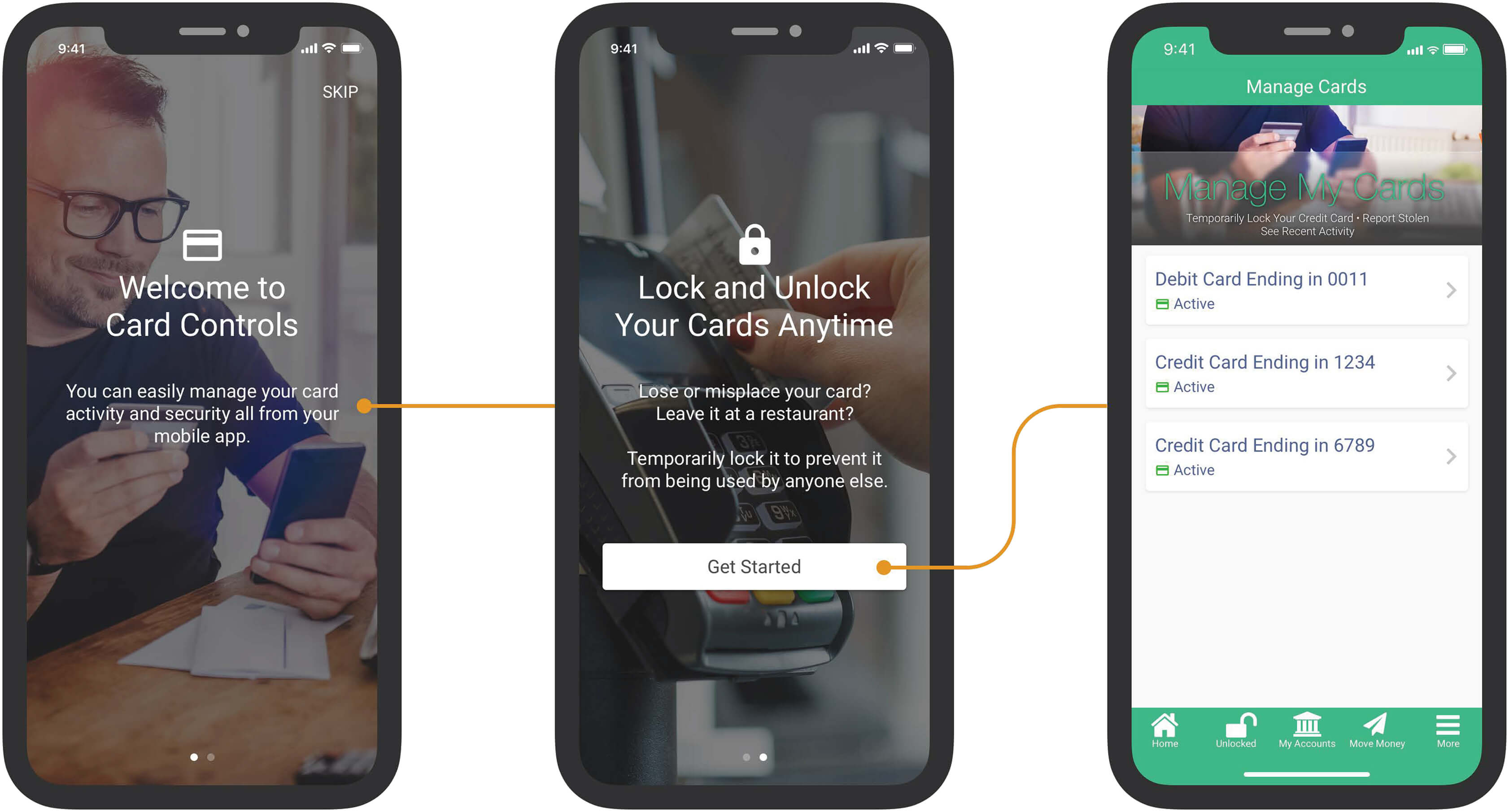

The locked status will be shown on both the Card Summary and Manage Cards screens.

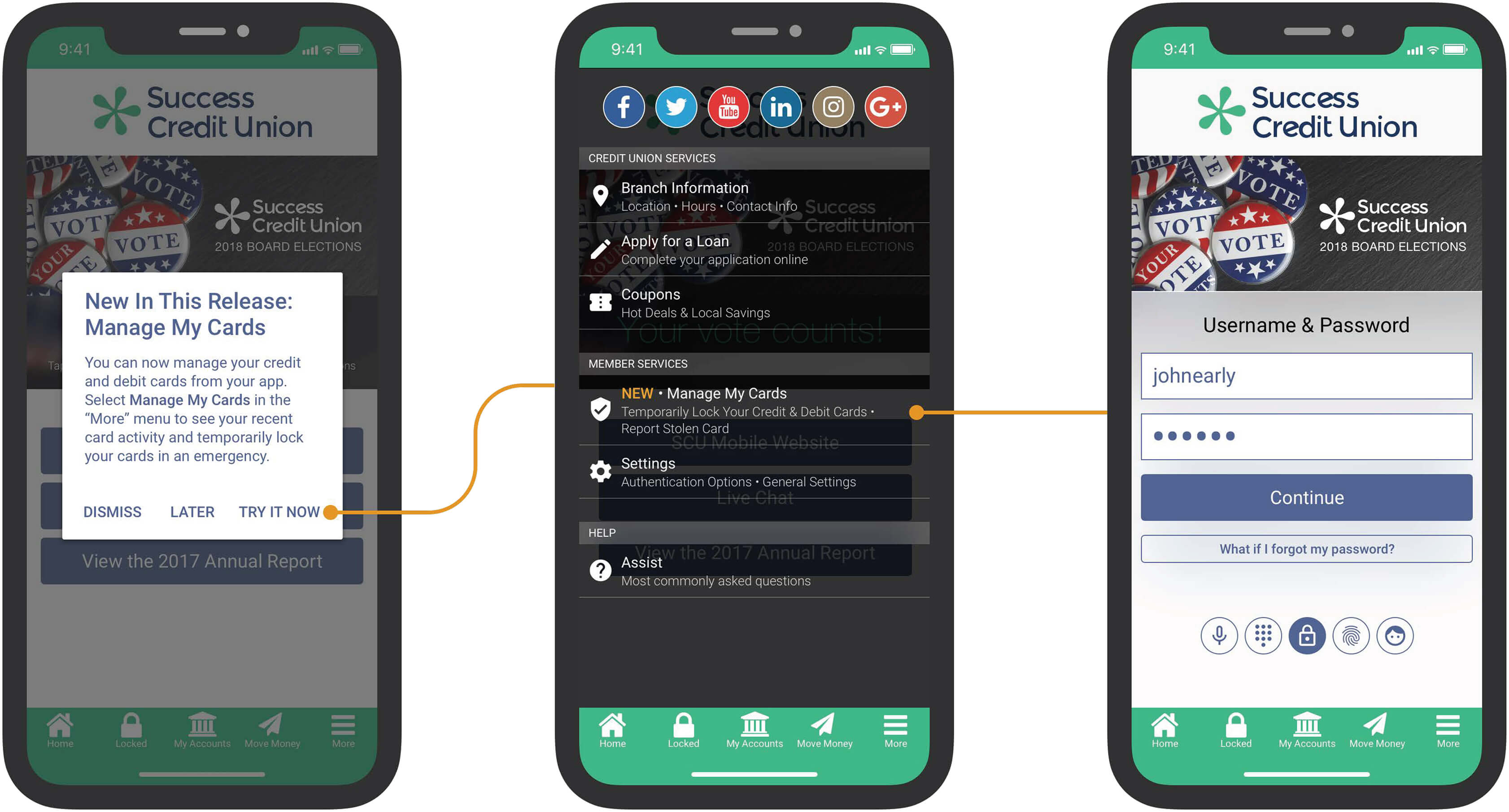

1. Select Manage My Cards from the “More” menu. (You will be required to login to your account.

2. Click “Get Started” to enable this feature. Once you are on the Manage My Cards screen, you will see your cards. Select a card to see recent activity and temporarily lock/unlock your cards.

Locking Credit or Debit Cards

From the Card Summary screen, you can temporarily lock your credit and debit cards associated with an account. This process will be identical for credit and debit cards.